Page 13 - F6 - Capital Allowances - Leases

P. 13

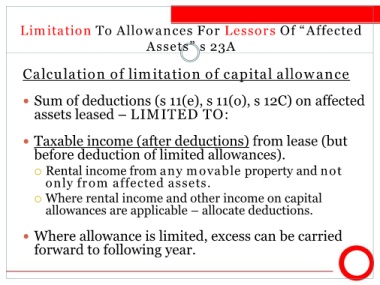

Limitation To Allowances For Lessors Of “Affected

Assets” s 23A

Calculation of limitation of capital allowance

Sum of deductions (s 11(e), s 11(o), s 12C) on affected

assets leased – LIMITED TO:

Taxable income (after deductions) from lease (but

before deduction of limited allowances).

Rental income from any movable property and not

only from affected assets.

Where rental income and other income on capital

allowances are applicable – allocate deductions.

Where allowance is limited, excess can be carried

forward to following year.