Page 8 - F6 - Capital Allowances - Leases

P. 8

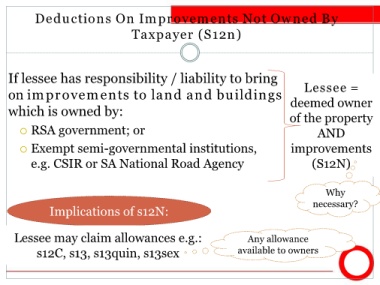

Deductions On Improvements Not Owned By

Taxpayer (S12n)

If lessee has responsibility / liability to bring

on improvements to land and buildings Lessee =

which is owned by: deemed owner

of the property

RSA government; or AND

Exempt semi-governmental institutions, improvements

e.g. CSIR or SA National Road Agency (S12N)

Why

necessary?

Implications of s12N:

Lessee may claim allowances e.g.: Any allowance

s12C, s13, s13quin, s13sex available to owners