Page 7 - F6 - Capital Allowances - Leases

P. 7

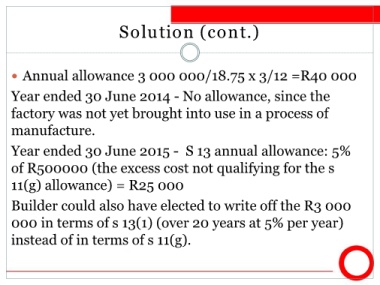

Solution (cont.)

Annual allowance 3 000 000/18.75 x 3/12 =R40 000

Year ended 30 June 2014 - No allowance, since the

factory was not yet brought into use in a process of

manufacture.

Year ended 30 June 2015 - S 13 annual allowance: 5%

of R500000 (the excess cost not qualifying for the s

11(g) allowance) = R25 000

Builder could also have elected to write off the R3 000

000 in terms of s 13(1) (over 20 years at 5% per year)

instead of in terms of s 11(g).