Page 9 - F6 - Capital Allowances - Leases

P. 9

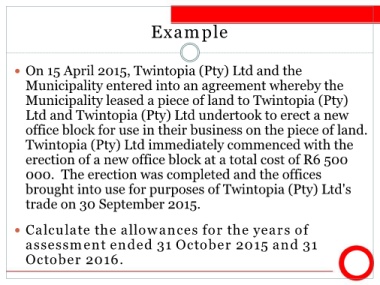

Example

On 15 April 2015, Twintopia (Pty) Ltd and the

Municipality entered into an agreement whereby the

Municipality leased a piece of land to Twintopia (Pty)

Ltd and Twintopia (Pty) Ltd undertook to erect a new

office block for use in their business on the piece of land.

Twintopia (Pty) Ltd immediately commenced with the

erection of a new office block at a total cost of R6 500

000. The erection was completed and the offices

brought into use for purposes of Twintopia (Pty) Ltd's

trade on 30 September 2015.

Calculate the allowances for the years of

assessment ended 31 October 2015 and 31

October 2016.