Page 17 - F6 - Capital Allowances - Leases

P. 17

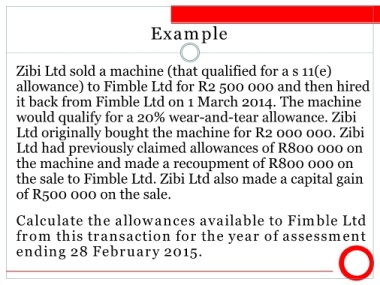

Example

Zibi Ltd sold a machine (that qualified for a s 11(e)

allowance) to Fimble Ltd for R2 500 000 and then hired

it back from Fimble Ltd on 1 March 2014. The machine

would qualify for a 20% wear-and-tear allowance. Zibi

Ltd originally bought the machine for R2 000 000. Zibi

Ltd had previously claimed allowances of R800 000 on

the machine and made a recoupment of R800 000 on

the sale to Fimble Ltd. Zibi Ltd also made a capital gain

of R500 000 on the sale.

Calculate the allowances available to Fimble Ltd

from this transaction for the year of assessment

ending 28 February 2015.