Page 16 - F6 - Capital Allowances - Leases

P. 16

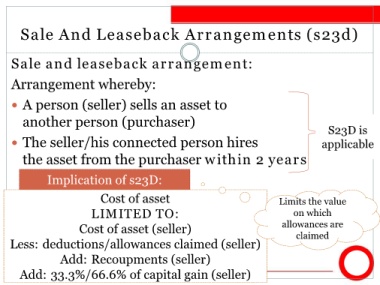

Sale And Leaseback Arrangements (s23d)

Sale and leaseback arrangement:

Arrangement whereby:

A person (seller) sells an asset to

another person (purchaser)

S23D is

The seller/his connected person hires applicable

the asset from the purchaser within 2 years

Implication of s23D:

Cost of asset Limits the value

LIMITED TO: on which

Cost of asset (seller) allowances are

claimed

Less: deductions/allowances claimed (seller)

Add: Recoupments (seller)

Add: 33.3%/66.6% of capital gain (seller)