Page 15 - F6 - Capital Allowances - Leases

P. 15

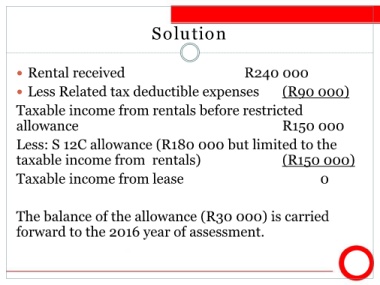

Solution

Rental received R240 000

Less Related tax deductible expenses (R90 000)

Taxable income from rentals before restricted

allowance R150 000

Less: S 12C allowance (R180 000 but limited to the

taxable income from rentals) (R150 000)

Taxable income from lease 0

The balance of the allowance (R30 000) is carried

forward to the 2016 year of assessment.