Page 10 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 10

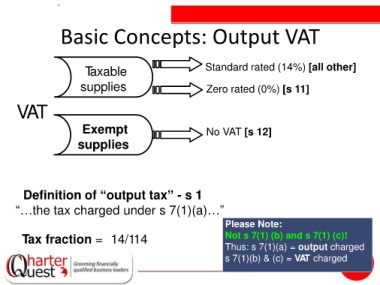

Basic Concepts: Output VAT

Taxable Standard rated (14%) [all other]

supplies Zero rated (0%) [s 11]

VAT

Exempt No VAT [s 12]

supplies

• Definition of “output tax” - s 1

“…the tax charged under s 7(1)(a)…”

Please Note:

• Tax fraction = 14/114 Not s 7(1) (b) and s 7(1) (c)!

Thus: s 7(1)(a) = output charged

s 7(1)(b) & (c) = VAT charged