Page 6 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 6

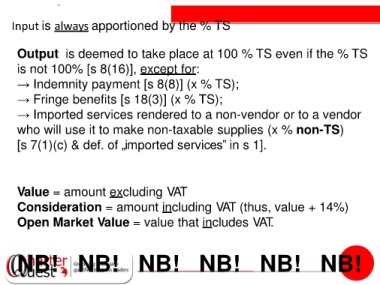

Input is always apportioned by the % TS

Output is deemed to take place at 100 % TS even if the % TS

is not 100% [s 8(16)], except for:

→ Indemnity payment [s 8(8)] (x % TS);

→ Fringe benefits [s 18(3)] (x % TS);

→ Imported services rendered to a non-vendor or to a vendor

who will use it to make non-taxable supplies (x % non-TS)

[s 7(1)(c) & def. of „imported services‟ in s 1].

Value = amount excluding VAT

Consideration = amount including VAT (thus, value + 14%)

Open Market Value = value that includes VAT.

NB! NB! NB! NB! NB! NB!