Page 7 - P6 Slide Taxation - Lecture Day 3 - VAT Part 1

P. 7

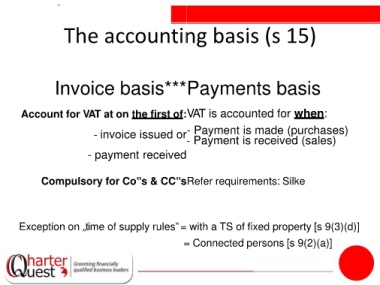

The accounting basis (s 15)

- Determines the timing of VAT payable/refundable

Invoice basis***Payments basis

Account for VAT at on the first of:VAT is accounted for when:

- invoice issued or - Payment is made (purchases)

- Payment is received (sales)

- payment received

Compulsory for Co‟s & CC‟sRefer requirements: Silke

***Exception on „time of supply rules‟= with a TS of fixed property [s 9(3)(d)]

= Connected persons [s 9(2)(a)]