Page 22 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 22

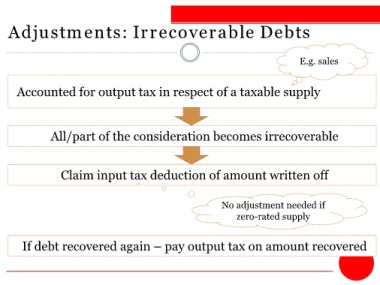

Adjustments: Irrecoverable Debts

E.g. sales

Accounted for output tax in respect of a taxable supply

All/part of the consideration becomes irrecoverable

Claim input tax deduction of amount written off

No adjustment needed if

zero-rated supply

If debt recovered again – pay output tax on amount recovered