Page 19 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 19

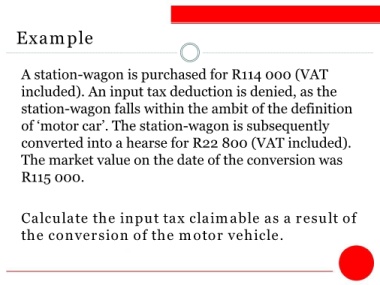

Example

A station-wagon is purchased for R114 000 (VAT

included). An input tax deduction is denied, as the

station-wagon falls within the ambit of the definition

of ‘motor car’. The station-wagon is subsequently

converted into a hearse for R22 800 (VAT included).

The market value on the date of the conversion was

R115 000.

Calculate the input tax claimable as a result of

the conversion of the motor vehicle.