Page 14 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 14

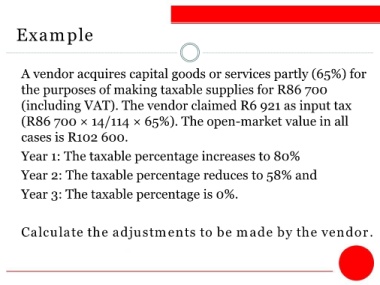

Example

A vendor acquires capital goods or services partly (65%) for

the purposes of making taxable supplies for R86 700

(including VAT). The vendor claimed R6 921 as input tax

(R86 700 × 14/114 × 65%). The open-market value in all

cases is R102 600.

Year 1: The taxable percentage increases to 80%

Year 2: The taxable percentage reduces to 58% and

Year 3: The taxable percentage is 0%.

Calculate the adjustments to be made by the vendor.