Page 12 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 12

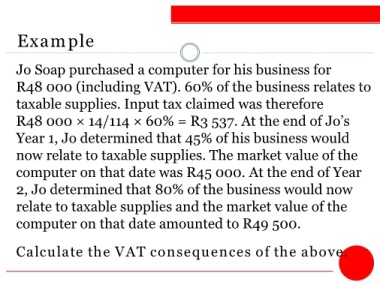

Example

Jo Soap purchased a computer for his business for

R48 000 (including VAT). 60% of the business relates to

taxable supplies. Input tax claimed was therefore

R48 000 × 14/114 × 60% = R3 537. At the end of Jo’s

Year 1, Jo determined that 45% of his business would

now relate to taxable supplies. The market value of the

computer on that date was R45 000. At the end of Year

2, Jo determined that 80% of the business would now

relate to taxable supplies and the market value of the

computer on that date amounted to R49 500.

Calculate the VAT consequences of the above.