Page 10 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 10

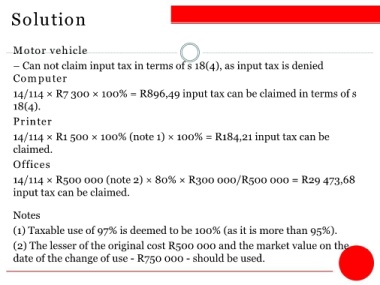

Solution

Motor vehicle

– Can not claim input tax in terms of s 18(4), as input tax is denied

Computer

14/114 × R7 300 × 100% = R896,49 input tax can be claimed in terms of s

18(4).

Printer

14/114 × R1 500 × 100% (note 1) × 100% = R184,21 input tax can be

claimed.

Offices

14/114 × R500 000 (note 2) × 80% × R300 000/R500 000 = R29 473,68

input tax can be claimed.

Notes

(1) Taxable use of 97% is deemed to be 100% (as it is more than 95%).

(2) The lesser of the original cost R500 000 and the market value on the

date of the change of use - R750 000 - should be used.