Page 15 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 15

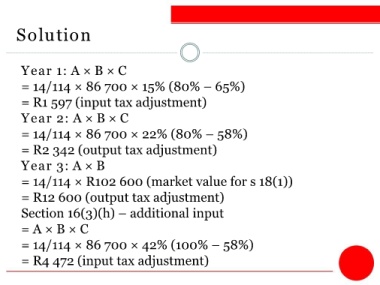

Solution

Year 1: A × B × C

= 14/114 × 86 700 × 15% (80% – 65%)

= R1 597 (input tax adjustment)

Year 2: A × B × C

= 14/114 × 86 700 × 22% (80% – 58%)

= R2 342 (output tax adjustment)

Year 3: A × B

= 14/114 × R102 600 (market value for s 18(1))

= R12 600 (output tax adjustment)

Section 16(3)(h) – additional input

= A × B × C

= 14/114 × 86 700 × 42% (100% – 58%)

= R4 472 (input tax adjustment)