Page 11 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 11

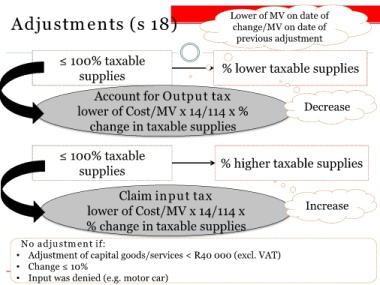

Adjustments (s 18) Lower of MV on date of

change/MV on date of

previous adjustment

≤ 100% taxable

supplies % lower taxable supplies

Account for Output tax

lower of Cost/MV x 14/114 x % Decrease

change in taxable supplies

≤ 100% taxable % higher taxable supplies

supplies

Claim input tax

lower of Cost/MV x 14/114 x Increase

% change in taxable supplies

No adjustment if:

• Adjustment of capital goods/services < R40 000 (excl. VAT)

• Change ≤ 10%

• Input was denied (e.g. motor car)