Page 8 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 8

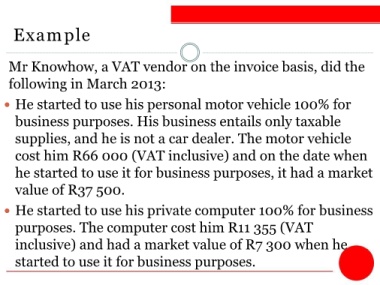

Example

Mr Knowhow, a VAT vendor on the invoice basis, did the

following in March 2013:

He started to use his personal motor vehicle 100% for

business purposes. His business entails only taxable

supplies, and he is not a car dealer. The motor vehicle

cost him R66 000 (VAT inclusive) and on the date when

he started to use it for business purposes, it had a market

value of R37 500.

He started to use his private computer 100% for business

purposes. The computer cost him R11 355 (VAT

inclusive) and had a market value of R7 300 when he

started to use it for business purposes.