Page 13 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 13

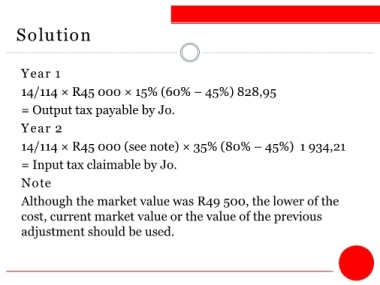

Solution

Year 1

14/114 × R45 000 × 15% (60% – 45%) 828,95

= Output tax payable by Jo.

Year 2

14/114 × R45 000 (see note) × 35% (80% – 45%) 1 934,21

= Input tax claimable by Jo.

Note

Although the market value was R49 500, the lower of the

cost, current market value or the value of the previous

adjustment should be used.