Page 16 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 16

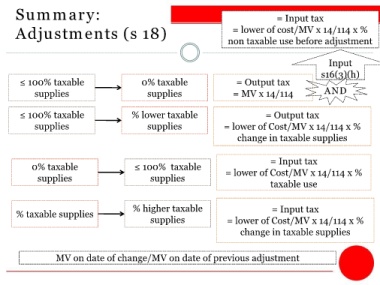

Summary: = Input tax

Adjustments (s 18) = lower of cost/MV x 14/114 x %

non taxable use before adjustment

Input

s16(3)(h)

≤ 100% taxable 0% taxable = Output tax

supplies supplies = MV x 14/114 AND

≤ 100% taxable % lower taxable = Output tax

supplies supplies = lower of Cost/MV x 14/114 x %

change in taxable supplies

= Input tax

0% taxable ≤ 100% taxable = lower of Cost/MV x 14/114 x %

supplies supplies

taxable use

% higher taxable = Input tax

% taxable supplies

supplies = lower of Cost/MV x 14/114 x %

change in taxable supplies

MV on date of change/MV on date of previous adjustment