Page 20 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 20

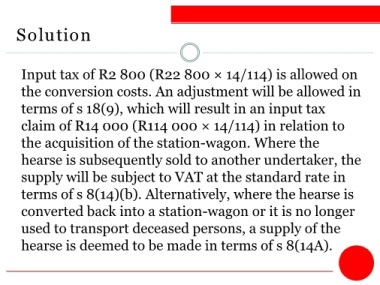

Solution

Input tax of R2 800 (R22 800 × 14/114) is allowed on

the conversion costs. An adjustment will be allowed in

terms of s 18(9), which will result in an input tax

claim of R14 000 (R114 000 × 14/114) in relation to

the acquisition of the station-wagon. Where the

hearse is subsequently sold to another undertaker, the

supply will be subject to VAT at the standard rate in

terms of s 8(14)(b). Alternatively, where the hearse is

converted back into a station-wagon or it is no longer

used to transport deceased persons, a supply of the

hearse is deemed to be made in terms of s 8(14A).