Page 9 - F6 Slide - VAT Part 5 - Lecture Day 5

P. 9

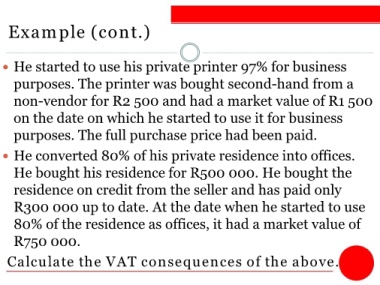

Example (cont.)

He started to use his private printer 97% for business

purposes. The printer was bought second-hand from a

non-vendor for R2 500 and had a market value of R1 500

on the date on which he started to use it for business

purposes. The full purchase price had been paid.

He converted 80% of his private residence into offices.

He bought his residence for R500 000. He bought the

residence on credit from the seller and has paid only

R300 000 up to date. At the date when he started to use

80% of the residence as offices, it had a market value of

R750 000.

Calculate the VAT consequences of the above.