Page 204 - Microsoft Word - 00 CIMA F1 Prelims STUDENT 2018.docx

P. 204

Chapter 14

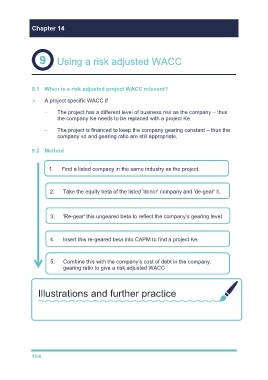

Using a risk adjusted WACC

9.1 When is a risk adjusted project WACC relevant?

A project specific WACC if

– The project has a different level of business risk as the company – thus

the company Ke needs to be replaced with a project Ke.

– The project is financed to keep the company gearing constant – thus the

company kd and gearing ratio are still appropriate.

9.2 Method

1. Find a listed company in the same industry as the project.

2. Take the equity beta of the listed 'donor' company and 'de-gear' it.

3. 'Re-gear' this ungeared beta to reflect the company’s gearing level.

4. Insert this re-geared beta into CAPM to find a project Ke.

5. Combine this with the company’s cost of debt in the company.

gearing ratio to give a risk adjusted WACC

Illustrations and further practice

Now try TYU 13 and 15 in Chapter 14

194