Page 37 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 37

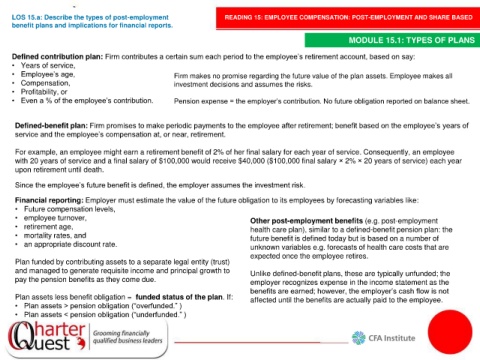

LOS 15.a: Describe the types of post-employment READING 15: EMPLOYEE COMPENSATION: POST-EMPLOYMENT AND SHARE BASED

benefit plans and implications for financial reports.

MODULE 15.1: TYPES OF PLANS

Defined contribution plan: Firm contributes a certain sum each period to the employee’s retirement account, based on say:

• Years of service,

• Employee’s age, Firm makes no promise regarding the future value of the plan assets. Employee makes all

• Compensation, investment decisions and assumes the risks.

• Profitability, or

• Even a % of the employee’s contribution. Pension expense = the employer’s contribution. No future obligation reported on balance sheet.

Defined-benefit plan: Firm promises to make periodic payments to the employee after retirement; benefit based on the employee’s years of

service and the employee’s compensation at, or near, retirement.

For example, an employee might earn a retirement benefit of 2% of her final salary for each year of service. Consequently, an employee

with 20 years of service and a final salary of $100,000 would receive $40,000 ($100,000 final salary × 2% × 20 years of service) each year

upon retirement until death.

Since the employee’s future benefit is defined, the employer assumes the investment risk.

Financial reporting: Employer must estimate the value of the future obligation to its employees by forecasting variables like:

• Future compensation levels,

• employee turnover, Other post-employment benefits (e.g. post-employment

• retirement age, health care plan), similar to a defined-benefit pension plan: the

• mortality rates, and future benefit is defined today but is based on a number of

• an appropriate discount rate. unknown variables e.g. forecasts of health care costs that are

expected once the employee retires.

Plan funded by contributing assets to a separate legal entity (trust)

and managed to generate requisite income and principal growth to Unlike defined-benefit plans, these are typically unfunded; the

pay the pension benefits as they come due. employer recognizes expense in the income statement as the

benefits are earned; however, the employer’s cash flow is not

Plan assets less benefit obligation = funded status of the plan. If: affected until the benefits are actually paid to the employee.

• Plan assets > pension obligation (“overfunded.” )

• Plan assets < pension obligation (“underfunded.” )