Page 39 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 39

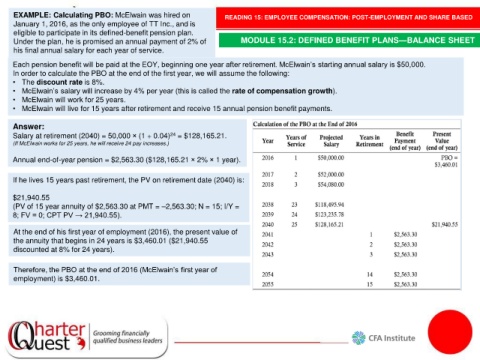

EXAMPLE: Calculating PBO: McElwain was hired on READING 15: EMPLOYEE COMPENSATION: POST-EMPLOYMENT AND SHARE BASED

January 1, 2016, as the only employee of TT Inc., and is

eligible to participate in its defined-benefit pension plan.

Under the plan, he is promised an annual payment of 2% of MODULE 15.2: DEFINED BENEFIT PLANS—BALANCE SHEET

his final annual salary for each year of service.

Each pension benefit will be paid at the EOY, beginning one year after retirement. McElwain’s starting annual salary is $50,000.

In order to calculate the PBO at the end of the first year, we will assume the following:

• The discount rate is 8%.

• McElwain’s salary will increase by 4% per year (this is called the rate of compensation growth).

• McElwain will work for 25 years.

• McElwain will live for 15 years after retirement and receive 15 annual pension benefit payments.

Answer:

Salary at retirement (2040) = 50,000 × (1 + 0.04) 24 = $128,165.21.

(If McElwain works for 25 years, he will receive 24 pay increases.)

Annual end-of-year pension = $2,563.30 ($128,165.21 × 2% × 1 year).

If he lives 15 years past retirement, the PV on retirement date (2040) is:

$21,940.55

(PV of 15 year annuity of $2,563.30 at PMT = –2,563.30; N = 15; I/Y =

8; FV = 0; CPT PV → 21,940.55).

At the end of his first year of employment (2016), the present value of

the annuity that begins in 24 years is $3,460.01 ($21,940.55

discounted at 8% for 24 years).

Therefore, the PBO at the end of 2016 (McElwain’s first year of

employment) is $3,460.01.