Page 40 - FINAL CFA II SLIDES JUNE 2019 DAY 5.2

P. 40

After 2, benefit is $5,126.61 ($128,165.21 × 2% × 2 years).

READING 15: EMPLOYEE COMPENSATION: POST-EMPLOYMENT AND SHARE BASED

PV of the payments on the retirement date (2040) is:

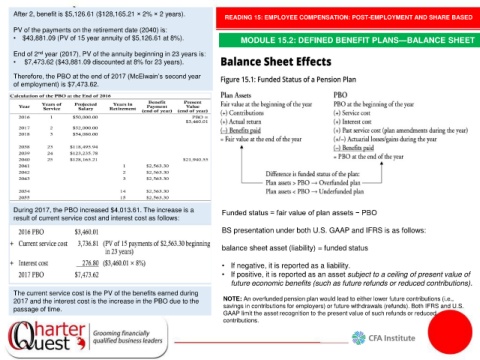

• $43,881.09 (PV of 15 year annuity of $5,126.61 at 8%). MODULE 15.2: DEFINED BENEFIT PLANS—BALANCE SHEET

End of 2 nd year (2017), PV of the annuity beginning in 23 years is:

• $7,473.62 ($43,881.09 discounted at 8% for 23 years).

Therefore, the PBO at the end of 2017 (McElwain’s second year

of employment) is $7,473.62.

During 2017, the PBO increased $4,013.61. The increase is a Funded status = fair value of plan assets − PBO

result of current service cost and interest cost as follows:

BS presentation under both U.S. GAAP and IFRS is as follows:

balance sheet asset (liability) = funded status

• If negative, it is reported as a liability.

• If positive, it is reported as an asset subject to a ceiling of present value of

future economic benefits (such as future refunds or reduced contributions).

The current service cost is the PV of the benefits earned during

2017 and the interest cost is the increase in the PBO due to the NOTE: An overfunded pension plan would lead to either lower future contributions (i.e.,

passage of time. savings in contributions for employers) or future withdrawals (refunds). Both IFRS and U.S.

GAAP limit the asset recognition to the present value of such refunds or reduced

contributions.