Page 24 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 24

Session Unit 10:

35. Capital Budgeting

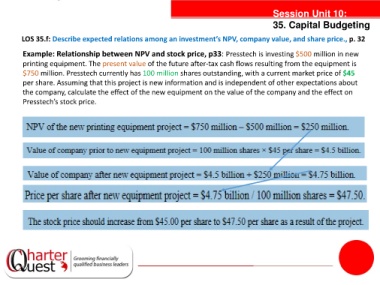

LOS 35.f: Describe expected relations among an investment’s NPV, company value, and share price., p. 32

Example: Relationship between NPV and stock price, p33: Presstech is investing $500 million in new

printing equipment. The present value of the future after-tax cash flows resulting from the equipment is

$750 million. Presstech currently has 100 million shares outstanding, with a current market price of $45

per share. Assuming that this project is new information and is independent of other expectations about

the company, calculate the effect of the new equipment on the value of the company and the effect on

Presstech’s stock price.

tanties