Page 28 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 28

Session Unit 10:

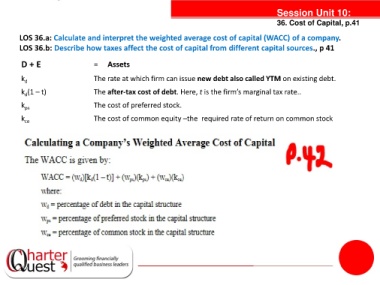

36. Cost of Capital, p.41

LOS 36.a: Calculate and interpret the weighted average cost of capital (WACC) of a company.

LOS 36.b: Describe how taxes affect the cost of capital from different capital sources., p 41

D + E = Assets

k d The rate at which firm can issue new debt also called YTM on existing debt.

k (1 – t) The after-tax cost of debt. Here, t is the firm’s marginal tax rate..

d

k ps The cost of preferred stock.

tanties

k The cost of common equity –the required rate of return on common stock

ce