Page 30 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 30

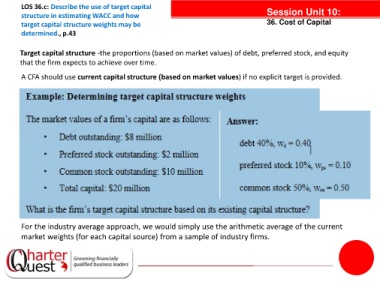

LOS 36.c: Describe the use of target capital

structure in estimating WACC and how Session Unit 10:

target capital structure weights may be 36. Cost of Capital

determined., p.43

Target capital structure -the proportions (based on market values) of debt, preferred stock, and equity

that the firm expects to achieve over time.

A CFA should use current capital structure (based on market values) if no explicit target is provided.

tanties

For the industry average approach, we would simply use the arithmetic average of the current

market weights (for each capital source) from a sample of industry firms.