Page 34 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 34

Session Unit 10:

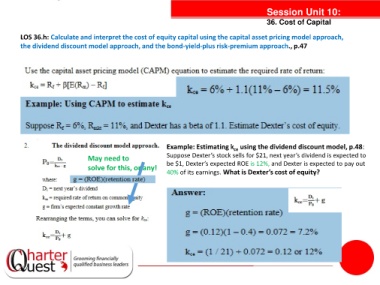

36. Cost of Capital

LOS 36.h: Calculate and interpret the cost of equity capital using the capital asset pricing model approach,

the dividend discount model approach, and the bond-yield-plus risk-premium approach., p.47

tanties

Example: Estimating k using the dividend discount model, p.48:

ce

May need to Suppose Dexter’s stock sells for $21, next year’s dividend is expected to

solve for this, or any! be $1, Dexter’s expected ROE is 12%, and Dexter is expected to pay out

40% of its earnings. What is Dexter’s cost of equity?