Page 37 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 37

Session Unit 10:

36. Cost of Capital

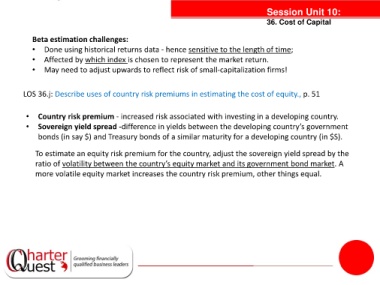

Beta estimation challenges:

• Done using historical returns data - hence sensitive to the length of time;

• Affected by which index is chosen to represent the market return.

• May need to adjust upwards to reflect risk of small-capitalization firms!

LOS 36.j: Describe uses of country risk premiums in estimating the cost of equity., p. 51

tanties

• Country risk premium - increased risk associated with investing in a developing country.

• Sovereign yield spread -difference in yields between the developing country’s government

bonds (in say $) and Treasury bonds of a similar maturity for a developing country (in $S).

To estimate an equity risk premium for the country, adjust the sovereign yield spread by the

ratio of volatility between the country’s equity market and its government bond market. A

more volatile equity market increases the country risk premium, other things equal.