Page 41 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 41

Session Unit 10:

36. Cost of Capital

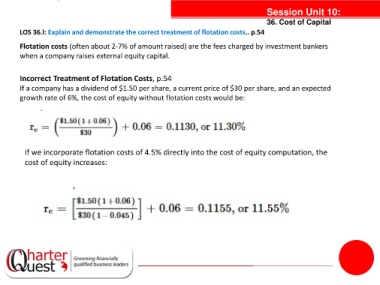

LOS 36.l: Explain and demonstrate the correct treatment of flotation costs.. p.54

Flotation costs (often about 2-7% of amount raised) are the fees charged by investment bankers

when a company raises external equity capital.

Incorrect Treatment of Flotation Costs, p.54

If a company has a dividend of $1.50 per share, a current price of $30 per share, and an expected

growth rate of 6%, the cost of equity without flotation costs would be:

tanties

If we incorporate flotation costs of 4.5% directly into the cost of equity computation, the

cost of equity increases: