Page 42 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 42

Session Unit 10:

36. Cost of Capital

Correct Treatment of Flotation Costs, p.55

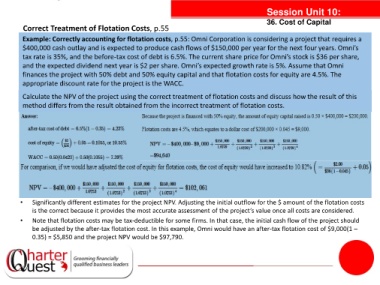

Example: Correctly accounting for flotation costs, p.55: Omni Corporation is considering a project that requires a

$400,000 cash outlay and is expected to produce cash flows of $150,000 per year for the next four years. Omni’s

tax rate is 35%, and the before-tax cost of debt is 6.5%. The current share price for Omni’s stock is $36 per share,

and the expected dividend next year is $2 per share. Omni’s expected growth rate is 5%. Assume that Omni

finances the project with 50% debt and 50% equity capital and that flotation costs for equity are 4.5%. The

appropriate discount rate for the project is the WACC.

Calculate the NPV of the project using the correct treatment of flotation costs and discuss how the result of this

method differs from the result obtained from the incorrect treatment of flotation costs.

tanties

• Significantly different estimates for the project NPV. Adjusting the initial outflow for the $ amount of the flotation costs

is the correct because it provides the most accurate assessment of the project’s value once all costs are considered.

• Note that flotation costs may be tax-deductible for some firms. In that case, the initial cash flow of the project should

be adjusted by the after-tax flotation cost. In this example, Omni would have an after-tax flotation cost of $9,000(1 –

0.35) = $5,850 and the project NPV would be $97,790.