Page 36 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 36

Session Unit 10:

36. Cost of Capital

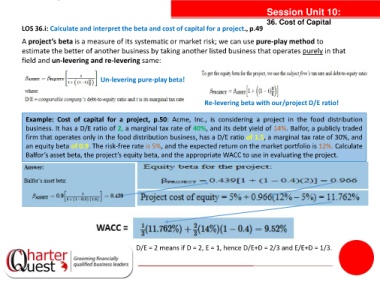

LOS 36.i: Calculate and interpret the beta and cost of capital for a project., p.49

A project’s beta is a measure of its systematic or market risk; we can use pure-play method to

estimate the better of another business by taking another listed business that operates purely in that

field and un-levering and re-levering same:

Un-levering pure-play beta!

Re-levering beta with our/project D/E ratio!

tanties

Example: Cost of capital for a project, p.50: Acme, Inc., is considering a project in the food distribution

business. It has a D/E ratio of 2, a marginal tax rate of 40%, and its debt yield of 14%. Balfor, a publicly traded

firm that operates only in the food distribution business, has a D/E ratio of 1.5, a marginal tax rate of 30%, and

an equity beta of 0.9. The risk-free rate is 5%, and the expected return on the market portfolio is 12%. Calculate

Balfor’s asset beta, the project’s equity beta, and the appropriate WACC to use in evaluating the project.

D/E = 2 means if D = 2, E = 1, hence D/E+D = 2/3 and E/E+D = 1/3.