Page 31 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 31

Session Unit 10:

36. Cost of Capital

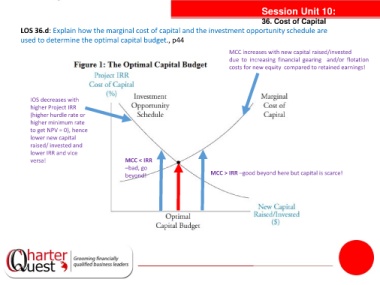

LOS 36.d: Explain how the marginal cost of capital and the investment opportunity schedule are

used to determine the optimal capital budget., p44

MCC increases with new capital raised/invested

due to increasing financial gearing and/or flotation

costs for new equity compared to retained earnings!

IOS decreases with

higher Project IRR

(higher hurdle rate or

higher minimum rate tanties

to get NPV = 0), hence

lower new capital

raised/ invested and

lower IRR and vice

versa! MCC < IRR

–bad, go

beyond! MCC > IRR –good beyond here but capital is scarce!