Page 19 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 19

Session Unit 10:

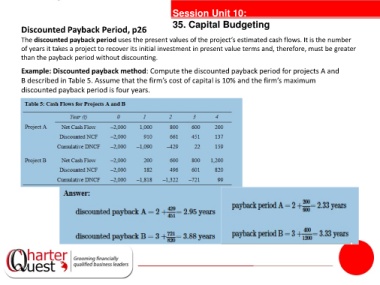

Discounted Payback Period, p26 35. Capital Budgeting

The discounted payback period uses the present values of the project’s estimated cash flows. It is the number

of years it takes a project to recover its initial investment in present value terms and, therefore, must be greater

than the payback period without discounting.

Example: Discounted payback method: Compute the discounted payback period for projects A and

B described in Table 5. Assume that the firm’s cost of capital is 10% and the firm’s maximum

discounted payback period is four years.

tanties