Page 14 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 14

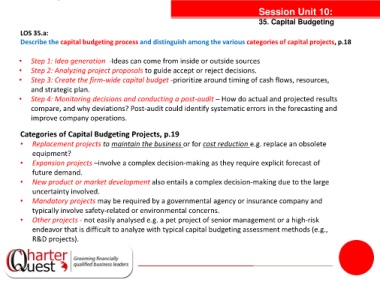

Session Unit 10:

35. Capital Budgeting

LOS 35.a:

Describe the capital budgeting process and distinguish among the various categories of capital projects, p.18

• Step 1: Idea generation -Ideas can come from inside or outside sources

• Step 2: Analyzing project proposals to guide accept or reject decisions.

• Step 3: Create the firm-wide capital budget -prioritize around timing of cash flows, resources,

and strategic plan.

• Step 4: Monitoring decisions and conducting a post-audit – How do actual and projected results

compare, and why deviations? Post-audit could identify systematic errors in the forecasting and

improve company operations. tanties

Categories of Capital Budgeting Projects, p.19

• Replacement projects to maintain the business or for cost reduction e.g. replace an obsolete

equipment?

• Expansion projects –involve a complex decision-making as they require explicit forecast of

future demand.

• New product or market development also entails a complex decision-making due to the large

uncertainty involved.

• Mandatory projects may be required by a governmental agency or insurance company and

typically involve safety-related or environmental concerns.

• Other projects - not easily analysed e.g. a pet project of senior management or a high-risk

endeavor that is difficult to analyze with typical capital budgeting assessment methods (e.g.,

R&D projects).