Page 11 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 11

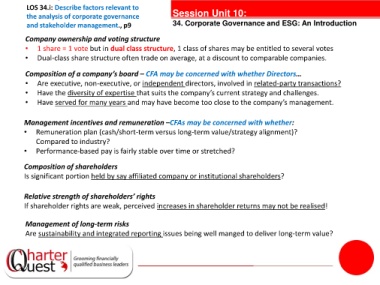

LOS 34.i: Describe factors relevant to

the analysis of corporate governance Session Unit 10:

and stakeholder management., p9 34. Corporate Governance and ESG: An Introduction

Company ownership and voting structure

• 1 share = 1 vote but in dual class structure, 1 class of shares may be entitled to several votes

• Dual-class share structure often trade on average, at a discount to comparable companies.

Composition of a company’s board – CFA may be concerned with whether Directors…

• Are executive, non-executive, or independent directors, involved in related-party transactions?

• Have the diversity of expertise that suits the company’s current strategy and challenges.

• Have served for many years and may have become too close to the company’s management.

tanties

Management incentives and remuneration –CFAs may be concerned with whether:

• Remuneration plan (cash/short-term versus long-term value/strategy alignment)?

Compared to industry?

• Performance-based pay is fairly stable over time or stretched?

Composition of shareholders

Is significant portion held by say affiliated company or institutional shareholders?

Relative strength of shareholders’ rights

If shareholder rights are weak, perceived increases in shareholder returns may not be realised!

Management of long-term risks

Are sustainability and integrated reporting issues being well manged to deliver long-term value?