Page 16 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 16

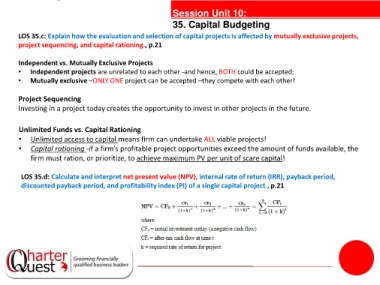

Session Unit 10:

35. Capital Budgeting

LOS 35.c: Explain how the evaluation and selection of capital projects is affected by mutually exclusive projects,

project sequencing, and capital rationing., p.21

Independent vs. Mutually Exclusive Projects

• Independent projects are unrelated to each other -and hence, BOTH could be accepted;

• Mutually exclusive –ONLY ONE project can be accepted –they compete with each other!

Project Sequencing

Investing in a project today creates the opportunity to invest in other projects in the future.

Unlimited Funds vs. Capital Rationing tanties

• Unlimited access to capital means firm can undertake ALL viable projects!

• Capital rationing -if a firm’s profitable project opportunities exceed the amount of funds available, the

firm must ration, or prioritize, to achieve maximum PV per unit of scare capital!

LOS 35.d: Calculate and interpret net present value (NPV), internal rate of return (IRR), payback period,

discounted payback period, and profitability index (PI) of a single capital project., p.21