Page 15 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 15

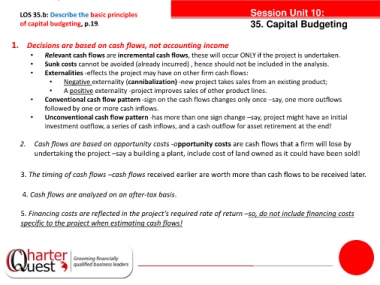

LOS 35.b: Describe the basic principles Session Unit 10:

of capital budgeting, p.19. 35. Capital Budgeting

1. Decisions are based on cash flows, not accounting income

• Relevant cash flows are incremental cash flows, these will occur ONLY if the project is undertaken.

• Sunk costs cannot be avoided (already incurred) , hence should not be included in the analysis.

• Externalities -effects the project may have on other firm cash flows:

• Negative externality (cannibalization) -new project takes sales from an existing product;

• A positive externality -project improves sales of other product lines.

• Conventional cash flow pattern -sign on the cash flows changes only once –say, one more outflows

followed by one or more cash inflows.

tanties

• Unconventional cash flow pattern -has more than one sign change –say, project might have an initial

investment outflow, a series of cash inflows, and a cash outflow for asset retirement at the end!

2. Cash flows are based on opportunity costs -opportunity costs are cash flows that a firm will lose by

undertaking the project –say a building a plant, include cost of land owned as it could have been sold!

3. The timing of cash flows –cash flows received earlier are worth more than cash flows to be received later.

4. Cash flows are analyzed on an after-tax basis.

5. Financing costs are reflected in the project’s required rate of return –so, do not include financing costs

specific to the project when estimating cash flows!