Page 8 - FINAL CFA SLIDES DECEMBER 2018 DAY 11

P. 8

Session Unit 10:

34. Corporate Governance and ESG: An Introduction

A governance committee is responsible for:

• Oversight of the company’s corporate governance and ethics code and polices.

• Monitoring changes in relevant laws and regulations and ensuring compliance

A nominations committee searches and proposes qualified candidates for election to the board, and

attempts to align the board’s composition with the company’s corporate governance policies.

A compensation committee or remuneration committee recommends director remuneration

tanties

amounts and types and oversees employee benefit plans and evaluation of senior managers.

A risk committee informs the board about appropriate risk policy and risk tolerance and oversees the

enterprise-wide risk management processes of the organization.

An investment committee reviews proposes large acquisitions or projects, sale or other disposal of

company assets or segments, and the performance of acquired assets and other large capital expenditures.

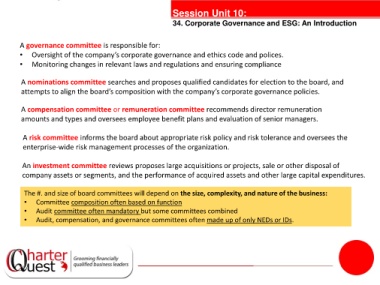

The #. and size of board committees will depend on the size, complexity, and nature of the business:

• Committee composition often based on function

• Audit committee often mandatory but some committees combined

• Audit, compensation, and governance committees often made up of only NEDs or IDs.