Page 25 - CIMA MCS Workbook February 2019 - Day 1 Suggested Solutions

P. 25

SUGGESTED SOLUTIONS

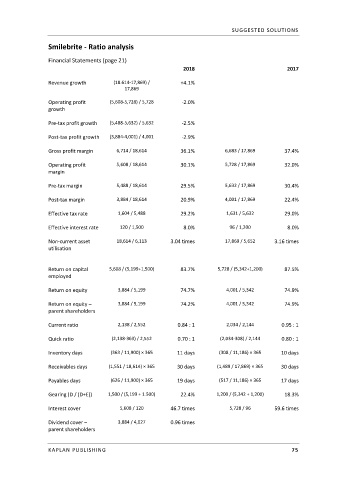

Smilebrite ‐ Ratio analysis

Financial Statements (page 21)

2018 2017

Revenue growth (18.614‐17,869) / +4.1%

17,869

Operating profit (5,608‐5,728) / 5,728 ‐2.0%

growth

Pre‐tax profit growth (5,488‐5,632) / 5,632 ‐2.5%

Post‐tax profit growth (3,884‐4,001) / 4,001 ‐2.9%

Gross profit margin 6,714 / 18,614 36.1% 6,683 / 17,869 37.4%

Operating profit 5,608 / 18,614 30.1% 5,728 / 17,869 32.0%

margin

Pre‐tax margin 5,488 / 18,614 29.5% 5,632 / 17,869 30.4%

Post‐tax margin 3,884 / 18,614 20.9% 4,001 / 17,869 22.4%

Effective tax rate 1,604 / 5,488 29.2% 1,631 / 5,632 29.0%

Effective interest rate 120 / 1,500 8.0% 96 / 1,200 8.0%

Non‐current asset 18,614 / 6,113 3.04 times 17,869 / 5,652 3.16 times

utilisation

Return on capital 5,608 / (5,199+1,500) 83.7% 5,728 / (5,342+1,200) 87.5%

employed

Return on equity 3,884 / 5,199 74.7% 4,001 / 5,342 74.9%

Return on equity – 3,884 / 5,199 74.2% 4,001 / 5,342 74.9%

parent shareholders

Current ratio 2,138 / 2,552 0.84 : 1 2,034 / 2,144 0.95 : 1

Quick ratio (2,138‐363) / 2,552 0.70 : 1 (2,034‐308) / 2,144 0.80 : 1

Inventory days (363 / 11,900) × 365 11 days (308 / 11,186) × 365 10 days

Receivables days (1,551 / 18,614) × 365 30 days (1,489 / 17,869) × 365 30 days

Payables days (626 / 11,900) × 365 19 days (517 / 11,186) × 365 17 days

Gearing (D / (D+E)) 1,500 / (5,199 + 1.500) 22.4% 1,200 / (5,342 + 1,200) 18.3%

Interest cover 5,608 / 120 46.7 times 5,728 / 96 59.6 times

Dividend cover – 3,884 / 4,027 0.96 times

parent shareholders

KAPLAN PUBLISHING 75