Page 45 - P6 Slide Taxation - Lecture Day 2 - Trust

P. 45

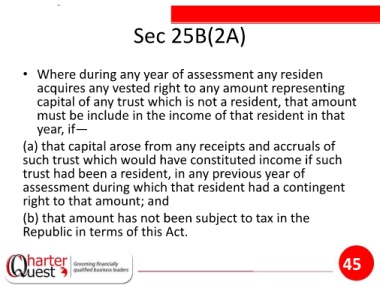

Sec 25B(2A)

• Where during any year of assessment any residen

acquires any vested right to any amount representing

capital of any trust which is not a resident, that amount

must be include in the income of that resident in that

year, if—

(a) that capital arose from any receipts and accruals of

such trust which would have constituted income if such

trust had been a resident, in any previous year of

assessment during which that resident had a contingent

right to that amount; and

(b) that amount has not been subject to tax in the

Republic in terms of this Act.

45