Page 46 - P6 Slide Taxation - Lecture Day 2 - Trust

P. 46

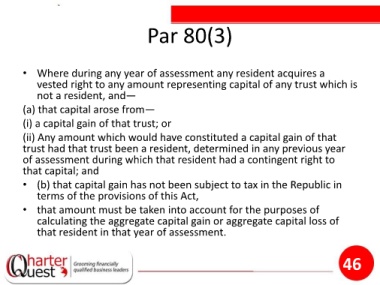

Par 80(3)

• Where during any year of assessment any resident acquires a

vested right to any amount representing capital of any trust which is

not a resident, and—

(a) that capital arose from—

(i) a capital gain of that trust; or

(ii) Any amount which would have constituted a capital gain of that

trust had that trust been a resident, determined in any previous year

of assessment during which that resident had a contingent right to

that capital; and

• (b) that capital gain has not been subject to tax in the Republic in

terms of the provisions of this Act,

• that amount must be taken into account for the purposes of

calculating the aggregate capital gain or aggregate capital loss of

that resident in that year of assessment.

46