Page 3 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 3

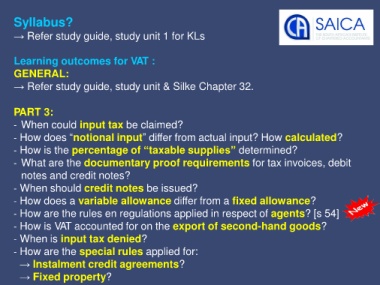

Syllabus?

→ Refer study guide, study unit 1 for KLs

Learning outcomes for VAT :

GENERAL:

→ Refer study guide, study unit & Silke Chapter 32.

PART 3:

- When could input tax be claimed?

- How does “notional input” differ from actual input? How calculated?

- How is the percentage of “taxable supplies” determined?

- What are the documentary proof requirements for tax invoices, debit

notes and credit notes?

- When should credit notes be issued?

- How does a variable allowance differ from a fixed allowance?

- How are the rules en regulations applied in respect of agents? [s 54]

- How is VAT accounted for on the export of second-hand goods?

- When is input tax denied?

- How are the special rules applied for:

→ Instalment credit agreements?

→ Fixed property?