Page 4 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 4

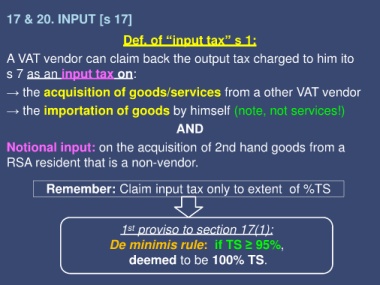

17 & 20. INPUT [s 17]

Def. of “input tax” s 1:

A VAT vendor can claim back the output tax charged to him ito

s 7 as an input tax on:

→ the acquisition of goods/services from a other VAT vendor

→ the importation of goods by himself (note, not services!)

AND

Notional input: on the acquisition of 2nd hand goods from a

RSA resident that is a non-vendor.

Remember: Claim input tax only to extent of %TS

1 proviso to section 17(1):

st

De minimis rule: if TS ≥ 95%,

deemed to be 100% TS.