Page 9 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 9

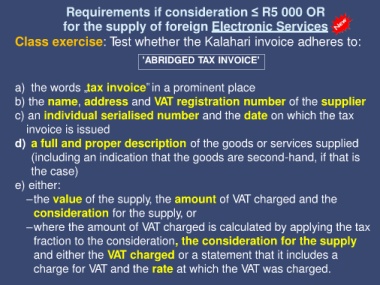

Requirements if consideration ≤ R5 000 OR

for the supply of foreign Electronic Services

Class exercise: Test whether the Kalahari invoice adheres to:

'ABRIDGED TAX INVOICE'

a) the words „tax invoice‟in a prominent place

b) the name, address and VAT registration number of the supplier

c) an individual serialised number and the date on which the tax

invoice is issued

d) a full and proper description of the goods or services supplied

(including an indication that the goods are second-hand, if that is

the case)

e) either:

–the value of the supply, the amount of VAT charged and the

consideration for the supply, or

–where the amount of VAT charged is calculated by applying the tax

fraction to the consideration, the consideration for the supply

and either the VAT charged or a statement that it includes a

charge for VAT and the rate at which the VAT was charged.