Page 14 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 14

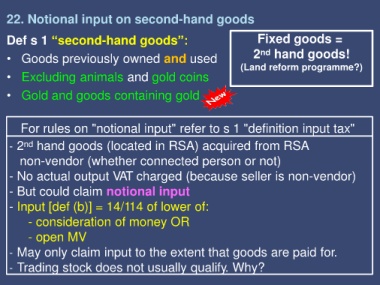

22. Notional input on second-hand goods

Def s 1 “second-hand goods”: Fixed goods =

• Goods previously owned and used 2 nd hand goods!

(Land reform programme?)

• Excluding animals and gold coins

• Gold and goods containing gold

For rules on "notional input" refer to s 1 "definition input tax"

- 2 nd hand goods (located in RSA) acquired from RSA

non-vendor (whether connected person or not)

- No actual output VAT charged (because seller is non-vendor)

- But could claim notional input

- Input [def (b)] = 14/114 of lower of:

- consideration of money OR

- open MV

- May only claim input to the extent that goods are paid for.

- Trading stock does not usually qualify. Why?