Page 15 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 15

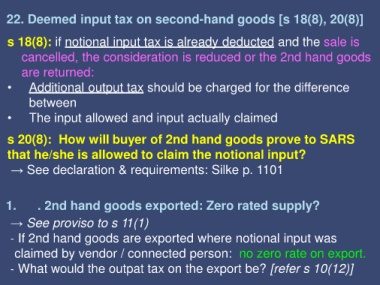

22. Deemed input tax on second-hand goods [s 18(8), 20(8)]

s 18(8): if notional input tax is already deducted and the sale is

cancelled, the consideration is reduced or the 2nd hand goods

are returned:

• Additional output tax should be charged for the difference

between

• The input allowed and input actually claimed

s 20(8): How will buyer of 2nd hand goods prove to SARS

that he/she is allowed to claim the notional input?

→ See declaration & requirements: Silke p. 1101

1. . 2nd hand goods exported: Zero rated supply?

→ See proviso to s 11(1)

- If 2nd hand goods are exported where notional input was

claimed by vendor / connected person: no zero rate on export.

- What would the outpat tax on the export be? [refer s 10(12)]