Page 16 - P6 Slide Taxation - Lecture Day 3 - VAT Part 3

P. 16

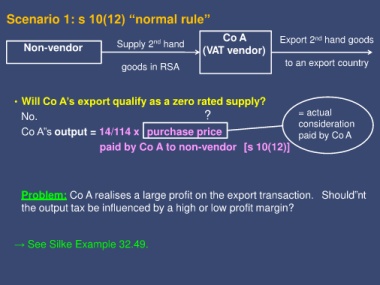

Scenario 1: s 10(12) “normal rule”

Co A Export 2 nd hand goods

nd

Non-vendor Supply 2 hand (VAT vendor)

goods in RSA to an export country

• Will Co A’s export qualify as a zero rated supply?

No. ? = actual

consideration

Co A‟s output = 14/114 x purchase price paid by Co A

paid by Co A to non-vendor [s 10(12)]

Problem: Co A realises a large profit on the export transaction. Should‟nt

the output tax be influenced by a high or low profit margin?

→ See Silke Example 32.49.